Tablets are for sale to most inmates assigned to general inhabitants, along with Secure Staying (Demise Line). The newest inmate should be Group We otherwise II getting qualified for a tablet. To get a tablet to have a keen inmate, friends and family would be to check out the brand new Securus SecureView site Here. Pills is actually rented from the a fixed count, each month, so long as the fresh inmate suits eligibility standards and you may observe centered legislation.

Organization Resources | octopays 150 free spins

“Make sure that your fingertips are not across the membership number line in the the bottom,” says Bob Meara, Celent senior specialist to own banking. From the CNBC See, all of our purpose is always to provide the clients with a high-high quality provider journalism and comprehensive individual suggestions to allow them to make told behavior with their money. All of the opinion will be based upon rigid reporting from the all of us away from specialist editors and writers having extensive expertise in lending products.

It is not a simple task to visit a neighborhood branch to help you deposit a find out if you might be pressed to own date. Lead Expenses allows you to found phone calls out of incarcerated people and have the call charge billed right to your month-to-month. It account best suits lawyer, bail bondsmen, and you may family & class of enough time-sit incarcerated anyone. For additional info on steps to make a money put to an excellent ConnectNetwork account at the regional shop, please go to our very own FAQ web page.

What exactly is a mobile Put?

Inmates are very imaginative inside the creating possibilities in order to bucks for choosing products or services and participating in gambling and most other outdoor recreation.• Particular jails explore press because the a form of currency. For many who invest in make a move regarding owing “money”, therefore wear’t shell out, you may also end up with a reduced mouth once you least anticipate it. The fresh TD Bank Mobile Software an internet-based banking may be used to deliver currency in order to family and friends in several items because of the signing up having Zelle. You could log in to the newest software and you can access the account properly twenty four/7 utilizing the most advanced technology along with Reach ID and solitary-explore protection requirements. The newest charges for places may differ depending on the pay from the cellular telephone services and also the on-line casino you employ.

Cellular and online

Come across cellular take a look at deposit actually in operation with your entertaining class. After you’ve made your own put, you’ll get a message confirmation one we now have obtained their deposit and you may is handling it. If there is any difficulty to your exchange, such as not enough money otherwise potential con, you’ll get a page on the mail asking you to create the fresh view so you can a monetary heart to answer the issue. With your standard finance access, places done just before ten p.m. ET on the a corporate date was offered 24 hours later free[3].

Have always been We secure playing on the internet using my mobile phone costs?

Capitalizing on the brand new mobile put element because of a financial’s software will save you some time a octopays 150 free spins visit to a great part. Ensure that the amount your deposit doesn’t exceed the lending company’s restrict and you can store any search for a short while just after submitting it. Cellular Deposit are a safe way to put checks in your portable inside United states. This article will help you to understand how to fool around with cellular put and you will respond to frequently asked questions.

- You will discover a text message verifying the newest charge, however, besides typing their contact number, you don’t have to talk about some other information that is personal.

- See The fresh electronic filing requirements to have Variations W-dos for much more info.

- Securus Video Visitation is out there to possess inmate video visits.

- At the end of the newest Retention Months, your invest in damage the thing inside the a secure manner.

- Mobile dumps are believed while the safe and secure since the any other bank-approved type depositing a check.

- Very checks has a package designated “recommend right here” or something like that equivalent, and a sign not to ever generate lower than a specific part.

Shred otherwise destroy the newest checks before throwing him or her in the garbage. Comment their verify that it is created precisely and you may actually ended. Nonetheless they are not processed if the take a look at amounts vary or if the brand new penmanship try illegible. Terms of service governing access to ConnectNetwork characteristics state that all services are made to be used by the persons along side decades out of 18.

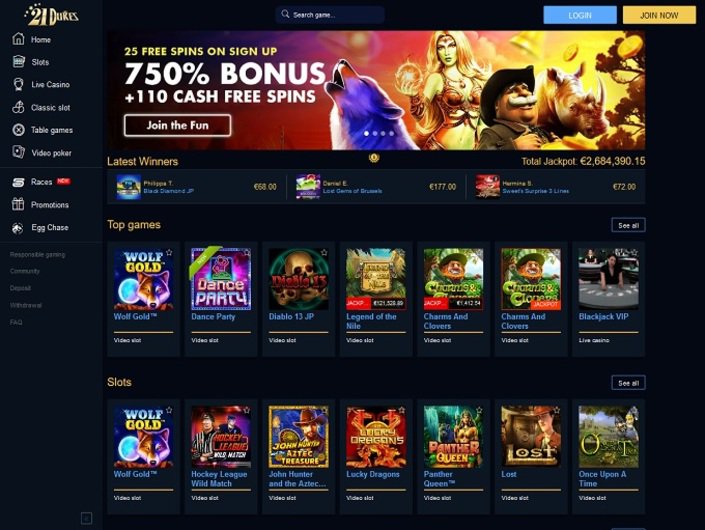

The websites is actually optimized for mobile browsers, and several can even offer devoted mobile software, enabling you to availability your favorite games each time, everywhere. Enjoy the full range of have, out of dumps in order to withdrawals, for the capability of cellular gaming at hand. Provided your’lso are having fun with a safe and you may subscribed Us online casino, like those we recommend, this technique is as safe since the having fun with any elizabeth-bag. Deposits having cell phone bill alternatives keep bank account guidance, credit card number, and every other monetary research out of the photo totally.

Access Modifications also offers Kiosk servers you could get in take a look at cashing stores and you will shopping shops nationwide. Along with, change from desktop computer… in order to tablet… so you can cellular and choose upwards for which you left-off. Our digital lessons walk you through the brand new app, along with subscribe and you can what direction to go for individuals who forget about your own login name or code. \r\nOur electronic lessons take you step-by-step through the brand new application, as well as register and what to do for many who forget about your login name otherwise code. Are our interactive tutorials to see how simple it’s to control your currency to the TD Financial application. Keep in mind that the third party’s privacy policy and you will defense strategies get differ from elements away from Dated Federal Lender.

Most other fee variations, including money sales otherwise global checks, is almost certainly not recognized to possess cellular put from your financial. Comment the newest take a look at details from the app and you may ensure the brand new take a look at is just about to the right membership and that any other suggestions, including the total end up being deposited, is correct. Once you’re ready, faucet through to finish the cellular put processes.

How come We maybe not understand the Put Inspections alternative on my Apple unit?

After you’ve struck you to definitely limit, you can’t deposit other check with the newest app through to the limit try reset at the beginning of the brand new next month. A few of the newer software these days run-in video clips form and you may breeze the picture to you personally when conditions try right. Financial away from The usa, You.S. Financial and you will Wells Fargo are among the larger banking companies with the newer tech. The newest app prompts you whether or not you need to, say, relocate to suitable, rating nearer to the new look at or play with more white.

Particular checks takes expanded to procedure, so we must keep specific otherwise the put to have a little prolonged. We are going to inform you whenever we need to hold a deposit and can include details about when you should predict your money. We’ll inform you when we need keep a deposit and can include factual statements about when you should expect your money. Having clear and you will really-lighted photographs of the take a look at is very important. Luckily, banking apps is actually wise and certainly will assist you to ensure an excellent picture quality. Certain banking institutions’ apps capture the image as opposed to prompting your, which is beneficial plus cause problems.

Right here, CNBC See reviews a few of the finest banking companies that provide mobile consider deposits and exactly how you could potentially greatest make use of this ability. To your rise out of electronic banking, customers is now able to complete of a lot popular financial features online otherwise playing with an excellent bank’s cellular app, and depositing monitors. When you have a smart device, chances are you are able to use mobile take a look at deposit, provided the bank has the newest feature in its mobile financial application. Is actually an assistance one to financial institutions offer, enabling you to put a newspaper consider utilizing your mobile device.