This means the holder of an existing contract would be required to take less than optimal profits or cover any losses incurred by the CFD provider. If the provider is unable to meet these obligations, then the value of the underlying asset is no longer relevant. It is important to recognize that the CFD industry is not highly regulated and the broker’s credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it’s important to investigate a broker’s background before opening an account.

- I have been writing about all aspects of household finance for over 30 years, aiming to provide information that will help readers make good choices with their money.

- The value of a CFD does not consider the asset’s underlying value, only the price change between the trade entry and exit.

- “Short” position (Sell)

In order to make a profit, the asset price must decrease. - You can also use CFD trades to hedge an existing physical portfolio.

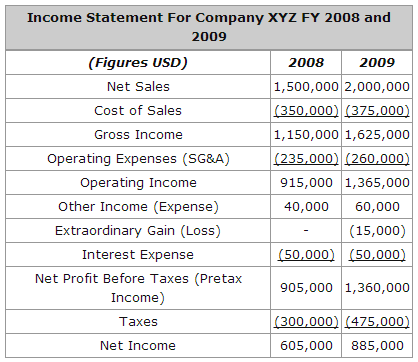

The trader will pay a 0.1% commission on opening the position and another 0.1% when the position is closed. For a long position, the trader will be charged a financing charge overnight (normally the LIBOR interest rate plus 2.5%). Futures contracts have an expiration date at which time there is an obligation to buy or sell the asset at a preset price.

Example 1 – Opening a share CFD trade

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Investors should always look for providers that are FCA-authorised or equivalent. You should always check with the product provider to ensure that information provided is the most up to date. These types of orders can be attached to a position at the time of opening, or you can modify an existing position. Discover the FxPro Wallet and variety of payment methods with 0 fees.

While CFDs offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. When the position is closed, the trader must pay another 0.01% commission fee of £10. For example, suppose that a trader wants to buy CFDs for the share price of GlaxoSmithKline.

The spread is the difference between the buy and sell prices (bid and ask) and is precisely the reason why each trade opens in minus. While CFDs are not available in the U.S. to retail investors, CFDs, swaps, and other highly leveraged derivatives are used by ndax review institutional investors. Other leverage instruments are available in the U.S. to retail investors. The investor would purchase 1,000 CFDs at the ask price of $10.00 to open a $10,000 CFD buy or “long” trade because they believe the price is going to rise.

What is CFD trading and how does it work?

We offer CFDs on a wide range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our most popular stock indices is the UK 100, which aggregates the price movements of all the stocks listed on the UK’s FTSE 100 index. The meaning of CFD is ‘contract for difference’, which is a contract between an investor and an investment bank or spread betting firm, usually in the short-term. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities. Trading CFDs means that you can either make a profit or loss, depending on which direction your chosen asset moves in.

This site does not include all companies or products available within the market. This article does not constitute investment advice, nor is it an offer or invitation to purchase any digital assets. You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before trading. The Low Carbon Contracts Company (LCCC) is a private company owned by DESNZ. The LCCC is counterparty to the contracts awarded in CfD allocation rounds (auctions) and its primary role is to issue the contracts, manage them during the construction and delivery phase and make CfD payments. A Contract for Difference (CfD) is a private law contract between a low carbon electricity generator and the Low Carbon Contracts Company (LCCC), a government-owned company.

Trading CFDs is riskier than conventional share trading, not suitable for the majority of investors, and includes the potential for partial or total loss of capital. Most often in this situation, the buyer is a trader and the seller is an investment firm or a broker. Contracts will typically last around a set number of days and the difference is settled in cash.

While it amplifies potential profits, it also increases the risk of significant losses. This example illustrates how a CFD allows a trader to speculate on the price movement of an asset without owning it, using leverage to amplify returns potentially. When trading CFDs, stop-loss orders can help mitigate the apparent risks. A guaranteed stop loss order, offered by some CFD providers, is a pre-determined price that, when met, automatically closes the contract. While CFDs are not subject to as many taxes as trades involving actual shares, they are subject to commissions and fees.

Example 2 – Opening a share CFD trade

Since CFDs come without any stamp duty, it cuts down on the cost and also acts as a great hedging tool by offsetting all losses against profits as a tax deduction. Get tight spreads, no hidden fees, access to 12,000+ instruments and more. Get tight spreads, no hidden fees and access to 12,000+ instruments. We must always pay attention to which is the underlying asset behind a derivative until we can reach the bottom of the chain and study the underlying asset in question.

Version 3: Contracts for difference on other commodity prices (not on carbon dioxide emissions)

Expectations of future carbon prices play a big role in determining the economic viability of various low-carbon projects—whether carbon capture and storage, green hydrogen, or clean electricity. But the risk of future governments moving away from that carbon pricing pathway dilutes policy certainty—and thus https://forex-review.net/ the incentive to invest in clean growth projects. Certain markets require minimum amounts of capital to day trade or place limits on the number of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions, and all account holders can day trade if they wish.

If the closing price is higher than the opening price, then the seller will pay that profit out to the buyer. If the closing price is lower than the opening price, then the buyer will have to pay that difference back to the seller. There is currently a discussion as to whether contract for difference solutions might also be a conceivable alternative to PPAs. They would reduce the investment risk and possible costs – which can occur especially with long-term PPAs.

Trading in CFDs is also known as spread trading, because those who trade them have to pay the difference – known as the spread – between the buy and sell prices. Contracts for differences (CFDs) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities; a client and the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

The company provides extensive educational material, including online courses and trading guides. Capital.com offers CFD trading in over 3,700 markets including shares, indices, commodities and currencies. In addition, CFDs usually levy a daily interest charge whenever a position is held overnight, and this is usually applied at a previously agreed rate.

How to decide if CFDs are right for you

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Once you know which strategies work best for you, you can enter the real market and start trading with a live account. At Blueberry Markets, we offer reliable sources in our digital library to learn more about CFDs and a dedicated account manager who can assist you in mitigating risk strategies. For example, Silver (XAG) is usually traded as a commodity in lots of 5,000 troy ounces. On the other hand, if you purchased Apple’s stocks, you would have had to invest the entire $80,000 amount together and later bear the loss of $50 per stock, along with additional costs.

74% of retail client accounts lose money when trading CFDs and/or spread bets with this provider. 82% of retail client accounts lose money when trading CFDs and spread bets with this provider. If the asset rises or falls in price, the buyer receives or earns cash from the seller. If you’re an experienced trader or just curious about trading, chances are you know of contracts for difference (CFD) trading. CFDs are derivative investment products where a trader can speculate on the price movements of an underlying asset.