For managerial purposes, the selling and administrative budgets and expenses are typically reviewed on a monthly, quarterly, and annual basis. This includes personnel expenses and also everyday operating expenses such as insurance, supplies, travel and entertainment, rent, and payroll taxes. Selling and administrative expenses even include non-cash expenses such as depreciation and amortization. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

What Is Management Accounting?

Analyses are often focused on targeted segments of a business rather than on a company as a whole. Managerial accounting involves not only actual financial data from past periods, but also current estimates and future projections. Management accounting professionals and students often benefit from the continuing education, networking, and career resources provided by accounting professional organizations.

Managers should not only calculate selling and administrative expenses but also analyze them

Managers of various teams and departments create reports such as budgets, financial forecasts and schedules and present them to senior management for decision-making. This information plays a critical role in business decisions based on the company’s financial circumstances, forecasts and trends. Most organizations require accounting services, so accounting programs often provide diverse concentration options focused on specific fields, roles, or skill sets. Popular accounting concentrations include auditing, cost accounting, financial accounting, and information systems. Some schools also offer specializations in fields such forensic accounting, environmental accounting, international taxation, or sports accounting.

How do I become a management accountant?

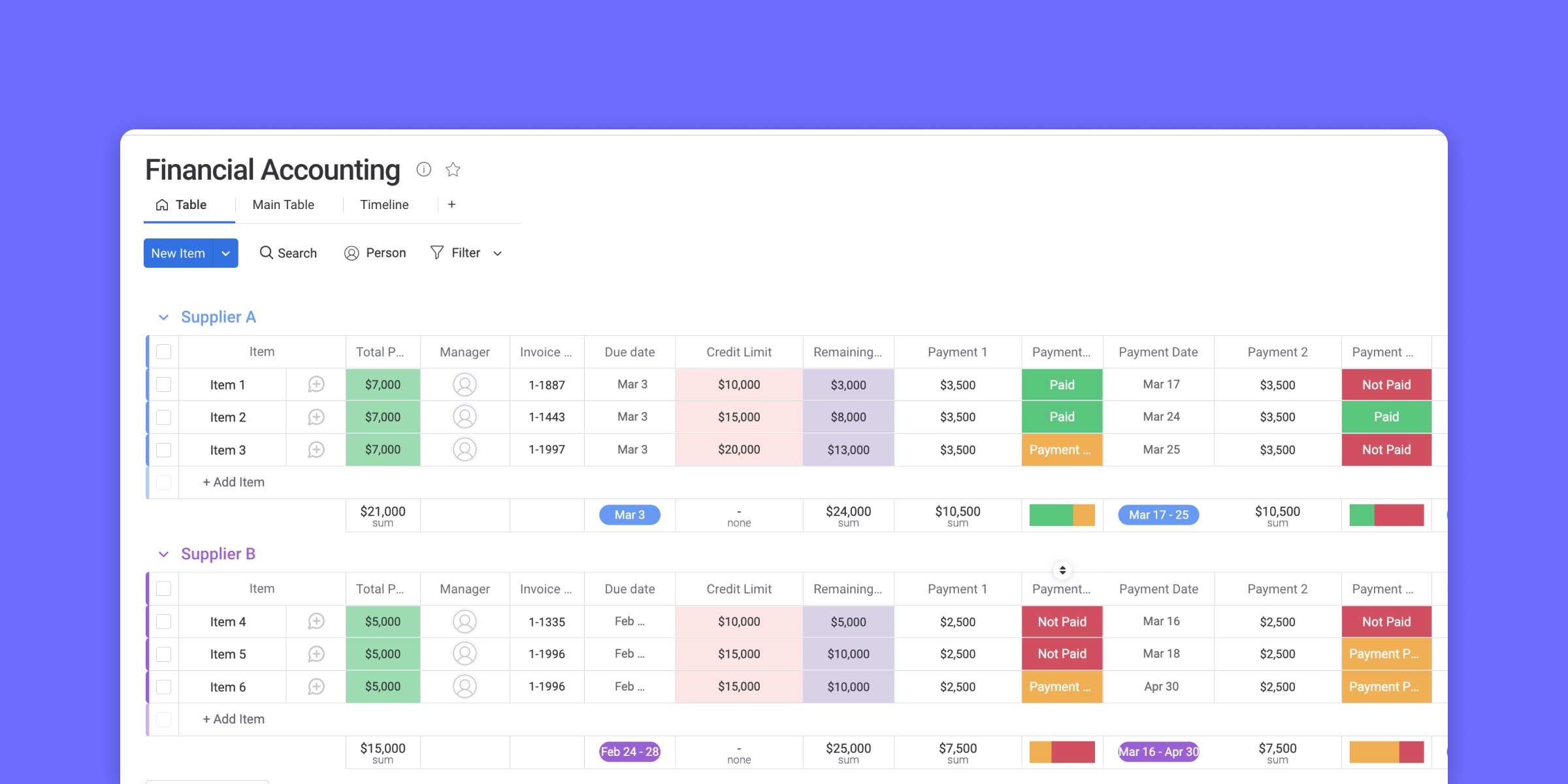

An accounts receivable aging report categorizes AR invoices by the length of time they have been outstanding. For example, my xero for partners an AR aging report may list all outstanding receivables less than 30 days, 30 to 60 days, 60 to 90 days, and 90+ days.

- Nonprofits must track restricted funds separately from unrestricted funds to maintain transparency and compliance.

- As management accountants gain more experience, they can earn up to £129,000, with the potential to earn large bonuses.

- It is important for management to review ratios and statistics regularly to be able to appropriately answer questions from its board of directors, investors, and creditors.

- Even if not a requirement for your degree program, seek internship options if possible.

- The Department of Homeland Security (DHS) is calling on those who want to help protect American interests and secure our Nation.

- Inventory turnover is a calculation of how many times a company has sold and replaced inventory in a given time period.

Join over 3,400 global companies that choose Coursera for Business

Managerial accounting is much more customizable than financial accounting, and therefore, it can provide many more practical tools for managers. Economic exposure is the degree to which the business’s value is affected by currency fluctuations, also known as forecast risk. The value of the foreign currency can impact the operating cashflows and the value of the assets.

Managerial accounting provides timely and relevant financial information that contributes to effective decision making. Unlike financial accounting, which focuses on reporting financial information to external parties like investors and regulators, managerial accounting focuses more internally and supports internal decision-making processes. You can make data-driven decisions based on your finances, but this data shouldn’t be the only factor you consider. Aspiring accounting and financial professionals face a bewildering array of degree, concentration, and career options. Individuals seeking high-paying financial analysis or management careers may do well to consider a management accounting concentration. A management accountant plays a crucial role in strategic decision-making within an organisation.

This is more common in Fortune 500 companies who have the resources to fund this type of training medium. Cash flow analysis studies the impact of a single financial decision or transaction to see the true impact of that purchase or decision. Financial professionals may look at several options and ways to finance a purchase based on that analysis. Cash flow analysis lets organizations make informed financial decisions and maintain sufficiently liquid assets in the short term. Within managerial accounting, several methods may be used to manage an organization’s finances.

In fact, accounting is often referred to as “the language of business” because business peoplecommunicate, evaluate performance, and determine value using dollars and amounts generated by the accounting process. Throughout my career, I’ve worked with many professionals in managerial accounting — from cost accountants to CFOs. The primary focus of managerial accounting is ensuring that a company has all the information required to make sound decisions that limit risk and maximize profits. The ultimate goal of managerial accounting is to support intelligent decision-making.

It is expected, however, that the Ph.D. candidate will spend at least 6 months at an international university as a visiting scholar. The entities falling under the Cherry Bekaert brand are independently owned and are not liable for the services provided by any other entity providing services under the Cherry Bekaert brand. Our use of the terms “our Firm” and “we” and “us” and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC. “Cherry Bekaert” is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC provide professional services. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

The activities management accountants provide inclusive of forecasting and planning, performing variance analysis, reviewing and monitoring costs inherent in the business are ones that have dual accountability to both finance and the business team. Managerial accounting is the process of analyzing, interpreting, and measuring an organization’s financial processes. This type of accounting uses data to help provide leaders with insight for strategic financial planning that aligns with that organization’s goals and business objectives. In managerial accounting, the main focus will be on financial decisions that affect the internal workings of a company. For example, managerial accountants may help leaders decide whether or not to raise the cost of goods and services. While competitive advantage does not directly affect tax compliance, it exerts an indirect positive influence through organizational performance.