If you’d like to learn more about algorithmic testing and trading, you can see the course offered by freeCodeCamp. Clients test their strategies on paper, not live within the trading platform, speculating on the exact points of entry and exit in certain conditions and documenting the results. When implementing any trading strategy, it’s important to take the necessary steps to manage your risk. Even in a simulated environment where there’s only virtual funds to be profited and lost, it’s vital to get exposure to positions that suit your risk appetite. Scenario analysis provides insights that can inform decision-making, risk management, and strategic comparison of social planning by considering a range of potential outcomes.

Backtesting is a methodical approach where traders evaluate the effectiveness of a trading strategy by applying the rules to historical data to see how the trading strategy would have performed. This technique allows traders to simulate a strategy’s performance without risking actual capital to find potentially profitable trading strategies. Backtesting refers to applying a trading system to historical data to verify how a system would have performed during the specified time period. Traders can test ideas with a few keystrokes and gain insight into the effectiveness of an idea without risking funds in a trading account. Backtesting can evaluate simple ideas, such as how a moving average crossover would perform on historical data, or more complex systems with a variety of inputs and triggers. It is a cornerstone in developing and validating trading strategies, ensuring they are huge surge in britons investing in cryptocurrencies like bitcoin robust and adaptable to various market conditions, and helps traders build confidence in their approach.

$42 Per Strategy

In summary, backtesting trading is a valuable tool for evaluating the potential profitability and risk of a trading strategy. By simulating the implementation of a strategy in the past and analyzing its performance, traders can make more informed decisions about which strategies to use in the future. Backtesting trading is the process of evaluating a trading strategy using historical data to determine its potential profitability. It involves simulating the implementation of a strategy in the past to see how it would have performed under certain market conditions.

There are many ways in which one trader can backtest his trading strategy, so its definition can vary. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

Crafting a Robust Trading Strategy Using Backtesting

Traders can use backtesting to generate and test hundreds of strategies in a single day, quickly confirming good ideas and discarding poor ones. You can use this process to generate and test hundreds of strategies in just a single day. Interestingly, backtesting is a great tool that can help you trial more ideas in a short time. If it didn’t perform well, you just drop the strategy and go on to test another idea.

As new data becomes available, the moving average is recalculated by replacing the oldest value with the latest one. Once you have shortlisted the assets, you would want to backtest your trading strategy. It is important to select high-quality data, that is, data without any errors. If you choose poor-quality data, then the output analysis from backtesting will be incorrect and misleading.

How do you account for leverage in backtesting CFD positions?

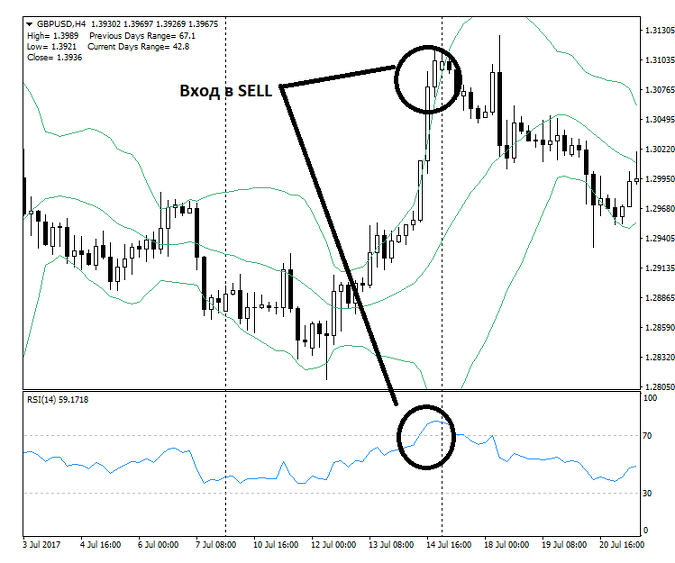

Printing the screenshot of the perfect trade helps you understand what you are looking for. Ideally, you want to end up with 30 to 50 trades in your backtest to get a meaningful sample size. Backtesting is a great way to spend your time as a developing trader and especially three benefits stand out. You need to make sure to test the strategy in different time periods with a variety of stocks.

- Be mindful that market conditions and dynamics may change, and live trading involves additional factors such as slippage, liquidity, and execution delays that can impact backtesting results.

- In the economic and financial field, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period.

- Backtesting is a powerful tool for portfolio optimization, enabling the analysis of returns, risk characteristics, and style exposures to refine asset allocation.

- Prior to initiating any backtesting or optimizing, traders can set aside a percentage of the historical data to be reserved for out-of-sample testing.

- Investopedia does not provide tax, investment, or financial services and advice.

- You can make it as complicated or simple as you´d like but in the beginning, to just get started, I recommend setting up a simple Excel spreadsheet.

It’s a simulation that runs the gauntlet of historical financial data to gauge the strategy’s mettle. Look-ahead bias occurs when future information is unintentionally used in the backtesting analysis, leading to unrealistic performance results. It is essential to ensure that only information available at the given point in time is used during the process of backtesting trading strategies. This requires careful attention to data availability and the exclusion of any future information that would not have been known during the historical testing period.

This can be done over the last few months, but we can also go 10 or 20 years back. All we need is a trading platform with access to the historical data and a simple spreadsheet where we will document all trades. By contrast, scenario analysis tests a strategy against a how to implement linear search and binary search algorithm in javascript set of hypothetical market conditions, perhaps not found in historical datasets. We will conduct a backtest on a trading strategy that utilises moving averages. Moving averages are calculated by taking the average of a specified data field, such as the price, over a consecutive set of periods.

The Importance of Maintaining Trading Records

These norms underscore the critical role backtesting plays in maintaining the stability of the financial system. Market conditions can change over time due to macroeconomic factors, policy changes, and shifts in investor sentiment. A strategy that performed well in one market regime may perform poorly in another, creating a significant limitation for backtesting.

What is backtesting?

StocksToTrade in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. In addition, StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as the sole basis of any investment decision, should it be construed as advice designed to meet the investment needs of any particular investor. Smart traders continue to backtest in some form to make sure their strategy still works as they expect. Let’s face it, even your top go-to trading strategies can stop working … even if it’s for a short amount of time. This can happen when you include future information that wasn’t available at the time of the testing period in the test.

It involves deciding when to enter and exit trades, as well as managing the size and timing of those trades. This includes choosing the appropriate order type, such as a market order or a limit order, and determining the appropriate position size for each trade. Since most ideas don’t work, you should not spend much time testing a strategy. Some traders waste a lot of time programming software and tweaking their strategies only to find out it was a waste of time.