Additionally, quarterly reporting may distract management’s attention away from long-term strategic planning, focusing instead on short-term performance targets. The income statement, balance sheet, and statement of cash flows are all parts of interim financial statements, just as they are in yearly financial statements. These papers’ line items will correspond to those in annual financial statements as well.

Please Sign in to set this content as a favorite.

Interim statements should be used whenever a business has set out specific goals and milestones that need to be achieved to ensure that everything is going as planned. // Intel is committed to respecting human rights and avoiding causing or contributing to adverse impacts on human rights. Intel’s products and software are intended only to be used in applications that do not cause or contribute to adverse impacts on human rights. For the full year, the company generated $8.3 billion in cash from operations and paid dividends of $1.6 billion.

Interim Financial Statements of the Government of New Zealand for the six months ended 31 December 2024

With seamless integration into existing financial tools and AI-powered insights, small business owners can make data-driven decisions and maximize profitability. As technology advances, online bookkeeping will continue to play a vital role in ensuring efficient, secure, and tax-compliant financial management. In interim financial statements, several further disclosures are optional or can be included in a more condensed manner. You might be wondering exactly what interim financial statements are and if they apply to your business. We’ll take a closer look at what’s included in interim financial statements, how they differ from other financial statements, and how to create interim financial statements for your business.

For example, a construction company working on a large state contract may be required to produce interim financial statements. Federal, state, and local governments may require businesses to create interim financial statements. Financial and accounting regulators determine the components of the interim financial statements. Given the cost and time required for an audit and the financial information requirement, it is mostly not audited and is also condensed; only the year-end annual financial statements are audited.

- Investors find the periodic snapshots helpful when allocating investment capital – all of which leads to greater market liquidity – a prime goal of capital markets.

- Whereas large corporations can often recover from a bad year, that bad year—or even a bad quarter—can spell disaster for a smaller business.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Quarterly reports are among the most common types of interim statements and are often mandated by regulatory bodies like the Securities and Exchange Commission (SEC).

- The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

- By outsourcing bookkeeping, businesses can reduce risks, stay audit-ready, and focus on growth with confidence.

In addition to reporting quarterly figures, these statements may also provide year-to-date and comparative (e.g., last year’s quarter to this year’s quarter) results. Publicly-traded companies must file their reports with the Securities Exchange Commission. This form, known as a 10-Q, does not include all the detailed information, such as background and operations detail that the annual report (known as a 10-K) would. An interim statement is a financial report presented to the revenue recognition definition accounting principle public before the end of an organization’s annual reporting cycle.

How Frequently Are Interim Statements Issued?

- By remaining transparent and providing accurate information, companies can maintain their credibility with shareholders and the market as a whole.

- It suggests the standards to be maintained while preparing these statements, which are almost similar to the auditable annual reports.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- The company creates an April 30th balance sheet and generates a balance sheet for December 31st of the prior year.

- Comparative statements of the previous year should be added to the Interim Financial Report.

- Annual financial statements are frequently audited, and the SEC requires a yearly audit of public companies.

Review the notes on the financial statements from the prior-year annual report and the most recent set of interim financial statements. A loan statement documents the monthly payment, interest rate, remaining principal balance, and the how to do bank reconciliation loan due date. A business may produce interim financial statements that include the loan statement data. Its quarterly financial statements are instead reviewed if a company is publicly-held. An outside auditor may conduct the review, but the activities are much reduced from those employed in an audit encompassed by a review. Therefore, reading the complete and previously issued annual financial statements and reports becomes essential.

Important Considerations for Institutional Investors

It suggests the standards to be maintained while preparing these statements, which are almost similar to the auditable annual reports. The accounting methods to be used for preparing these statements are also mentioned. The IASB also suggests that companies should follow the same guidelines in their interim statements as they use in preparing their annual reports (which are audited), including the use of similar accounting methods. Companies must follow specific accounting standards for interim reporting, like making sure all numbers are correct and honest. Even though they provide less detail than full-year reports, interim financial statements still give valuable clues about where a company stands financially between year-end wrap-ups. A company’s fiscal year end does not necessarily coincide with the calendar year; thus, quarters may conclude on various dates.

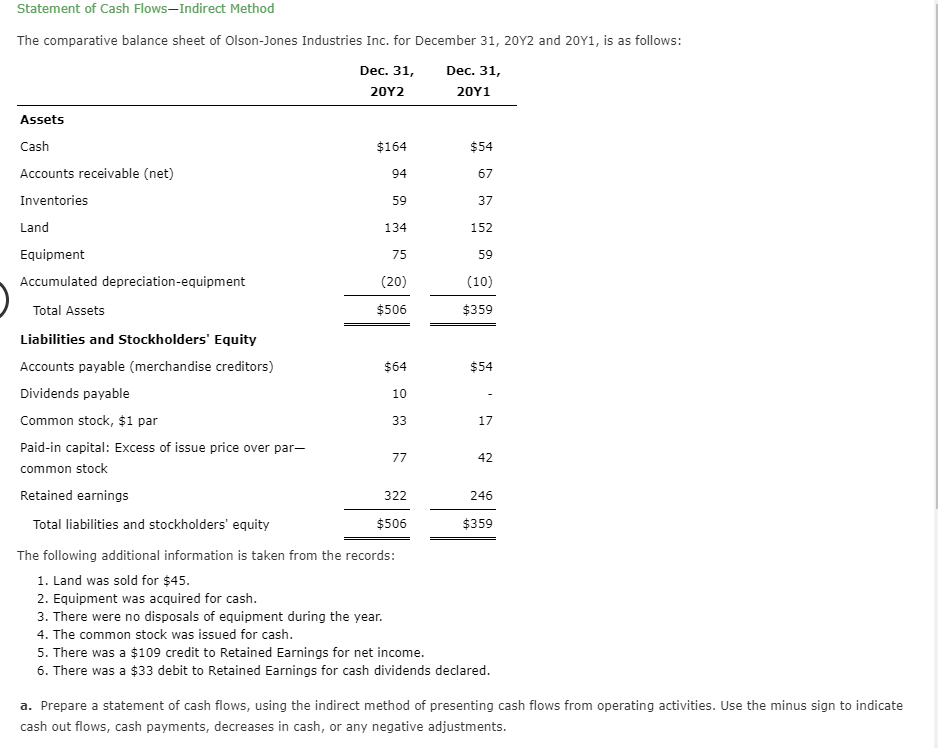

Everything to Run Your Business

They provide valuable insights into a company’s financial performance during non-annual reporting periods, fostering greater market liquidity and maintaining open communication channels between corporations and their stakeholders. By understanding the frequency and types of interim statements, investors can make more informed decisions when allocating investment capital. Interim statements, defined as financial reports covering periods less than one year, serve to keep investors and the public informed about a company’s performance between annual reporting cycles. The International Accounting Standards Board (IASB) establishes the standards and guidelines for preparing interim statements. These statements typically include condensed financial statements and relevant notes of explanation, adhering to the same accounting principles used in annual reports. A quarterly report is a summary or collection of un-audited financial statements, such as balance sheets, income statements, and cash flow statements, issued by companies every quarter (three months).

For example, a contingency is uncertainty regarding a possible gain or loss based on the outcome of a future event. what is the net sales formula Businesses produce a year-to-date statement of change in equity and a year-to-date statement for the prior year. Ask a question about your financial situation providing as much detail as possible.

However, in this case, overtime cannot be replaced by compensatory rest.

However, in this case, overtime cannot be replaced by compensatory rest.