However, due to various factors (like machinery downtime, labor issues, etc.), ABC Manufacturing only produced 9,000 units during that period. Sales Mix refers to the share of each product in total Sales, in terms of percentage. If you look at the number of units sold, you will see that in 2017, 50 apples were sold which is 28% of total sales of 180 units (50/180). By the time, you are finished with the article, you will be able to understand clearly how to calculate these variances. I will try to be concise, so I assume you are already aware of terms like Sales, margin, profits and variance etc. If you are not fully aware, click on Commonly used financial terms every new Financial Analyst and Accountant should know!

As per our calculation, there is a favorable production volume variance of $5,000. Adding these two variables together, we multiple overhead rates get an overall variance of $3,000 (unfavorable). It is a variance that management should look at and seek to improve.

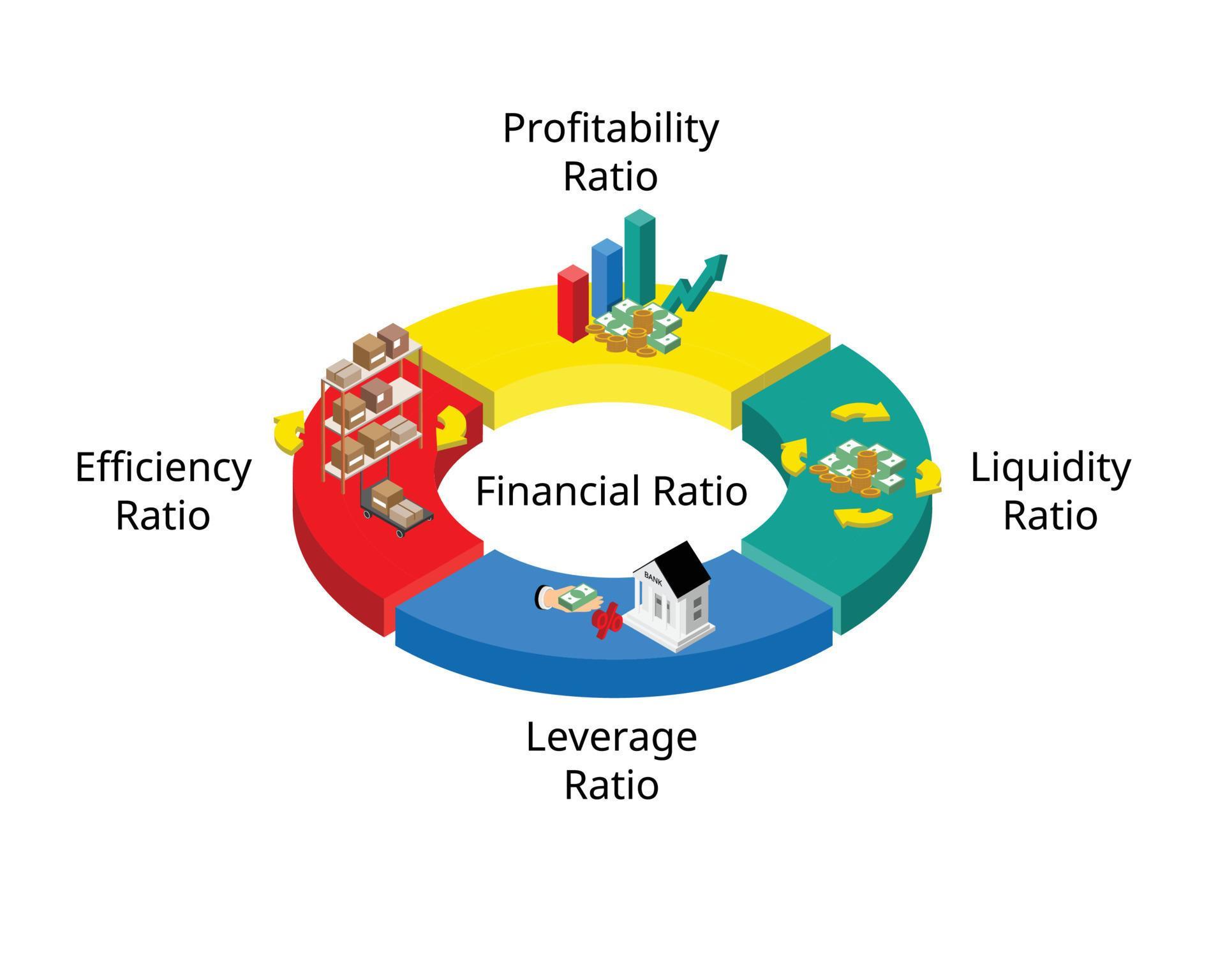

Production volume, capacity utilisation and efficiency ratios

Adding the budget variance and volume variance, we get a total unfavorable variance of $1,600. The third and final variance analysis, Rate Variance, is the change in rate and its impact on cost. If the cost of a product is higher or lower in a given period than what was planned, then this higher or lower rate is a Rate Variance.

- Total spending on raw materials, transportation of goods, and even storage may vary significantly with greater volumes of production.

- During that year, it expects to have 30,000 production machine hours of good output.

- In this case, two elements are contributing to the favorable outcome.

- We refer to these costs as the factory overhead, manufacturing overhead, or overhead costs.

Production volume variance can be incredibly useful to help determine a few things. This can include whether or not you can produce your products at a price that’s low enough. When you do this, you can make sure you’re able to also produce a high enough volume to operate at a profit. That said, there can be other costs that aren’t fixed as your total volume changes. This can include spending on raw materials, storage and the transportation of goods. This is since there can be several production costs that are fixed.

Would you prefer to work with a financial professional remotely or in-person?

In this case, two elements are contributing to the favorable outcome. Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. For example, if the actual cost is lower than the standard cost for raw materials, assuming the same volume of materials, it would lead to a favorable price variance (i.e., cost savings). However, if the standard quantity was 10,000 pieces of material and 15,000 pieces were required in production, this would be an unfavorable quantity variance because more materials were used than anticipated. Every volume variance involves the calculation of the difference in unit volumes, multiplied by a standard price or cost.

Which of these is most important for your financial advisor to have?

It’s very likely that the impact of a COGS variance is driven by all three components. Over the next few sections, I will outline how to calculate volume, mix and rate. This should help you determine how costs changes are affected by multiple cost drivers.

Direct Material Mix Variance:

As you can see from the various variance names, the term “volume” does not always enter into variance descriptions, so you need to examine their underlying formulas to determine which ones are actually volume variances. Production volume variance is a way that you can measure the actual cost of producing goods. And this gets done compared to the expectations that were outlined in your initial budget. Essentially, it compares your actual overhead costs per unit against your budgeted costs per item.

This example provides an opportunity to practice calculating the overhead variances that have been analyzed up to this point. Direct material Price Variance help management to measure the effect of the price of raw material that the entity purchase during the period and its standard price. Assuming Apple has the standard price for iPhone 7 Plus per unit, $800, and during the year, the actual price that is obtained from customers is $850 per unit. Variance Analysis is very important as it helps the management of an entity to control its operational performance and control direct material, direct labor, and many other resources.

Like an onion, we need to peel away the layers and separate out the causes so that management can better understand fluctuations, ask better questions and make more informed decisions. These rate changes have a direct impact on overall costs and will create a Rate Variance. You obviously want to make sure that you budget accordingly, but you don’t want to budget too much or too little. As mentioned above, Sales Quantity variance measures the impact of increase in volume, or quantity while maintaining previous year’s mix. The example uses data for 2017 and 2018 (current year vs last year) to calculate the variances.