Credits increase revenue, liabilities and equity accounts, whereas debits increase asset and expense accounts. Debits are recorded on the left side of the general ledger and credits are recorded on the right. The sum of every debit and its corresponding credit should always be zero. The debit entry increases the wood account and cash decreases with a credit so that the total change in assets equals zero.

- Double-entry bookkeeping (which is sometimes referred to as double-entry accounting) allows a business to record all its financial transactions in a structured way.

- Single-entry bookkeeping is a simple and less formal bookkeeping method commonly used by small businesses or individuals with relatively straightforward financial operations.

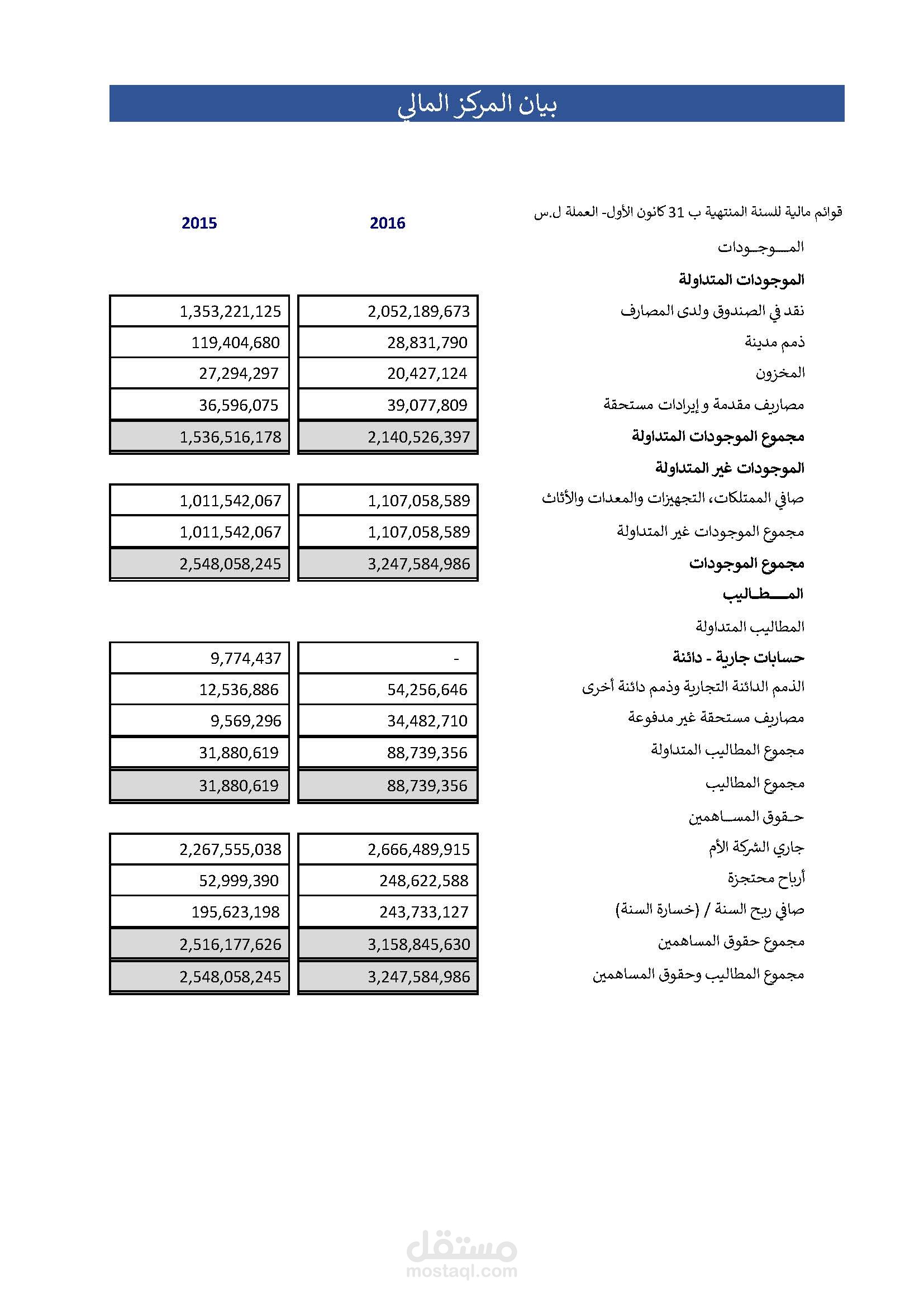

- If at any point this equation is out of balance, it will mean the bookkeeping process has gone wrong at some time.

- It allows a business to track all its transactions and helps it to understand how it is performing in terms of profitability, cash balances and business growth.

- Let’s look at some examples of how double-entry bookkeeping is used for some common accounting transactions.

- At any point in time, an accountant can produce a trial balance, which is a listing of each general ledger account and its current balance.

It’s a valuable tool that can provide structure and reliability in managing both business and personal finances. By tracking all entries in two accounts, double-entry bookkeeping also lets you spot and resolve any mistakes quickly and with accuracy. You’ll also be able to identify the profitable aspects of your business, and the ones that are less so. To enter that transaction properly, you would need to debit (increase) your cash account, and credit (decrease) your utilities expense account. While you can certainly create a chart of accounts manually, accounting software applications typically do this for you.

How to get started with double-entry accounting

At any point in time, an accountant can produce a trial balance, which is a listing of each general ledger account and its current balance. The total debits and credits on the trial balance will be equal to one another. Accountants frequently review the trial balance to verify that they posted journal entries correctly within the general ledger, as well as to correct any errors. This is a simple journal entry because the entry posts one debit and one credit entry.

This system is similar to tracking your expenses using pen and paper or Excel. Double-entry bookkeeping’s financial statements tell small businesses how profitable they are and how financially strong different parts of their business are. You invested $15,000 of your personal money to start your catering business. When you deposit $15,000 into your checking account, your cash increases by $15,000, and your equity increases by $15,000. For example, an e-commerce company buys $1,000 worth of inventory on credit.

As the business has accumulated the assets, a debit entry will be made in inventory with the amount equal to the cost of trucks i.e. As these are credit purchases, an entry with an equal amount has to be made on the credit side in accounts payable. Finally, to complete an entry the total of the Debit side and the Credit side should be equal. All debits do not always equate to increase the account nor do all credits equate to decrease the accounts.

The likelihood of administrative errors increases when a company expands, and its business transactions become increasingly complex. While double-entry bookkeeping does not eliminate all errors, it is effective in limiting errors on balance sheets and other financial statements because it requires debits and credits to balance. When entering business transactions into the accounting software, accountants need to ensure they link and source both the debit and credit entry.

A simple double-entry bookkeeping example

We specialise in supporting independent businesses and work with 80,684 clients. Each TaxAssist Accountant runs their own business, and are passionate about supporting you. You have started a new takeaway business and want to buy a new phone for when you are out on deliveries. A bookkeeping expert will contact you during business hours to discuss your needs. This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas.

Free Accounting Courses

Accurate bookkeeping is central to every small business’s success—including yours. Knowing exactly where you stand financially helps you make smart business is rubber biodegradable choices to improve profits while trimming costs. A sub-ledger may be kept for each individual account, which will only represent one-half of the entry.

Credits

The Credit Card Due sub-ledger would include a record of the other half of the entry, a credit for $5,000. The general ledger would have two lines added to it, showing both the debit and credit for $5,000 each. If you debit a cash account for $100, it means you add the money to the account, and if you credit it for $100, it means you subtract that money from the account.

In accounting, a debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger. To be in balance, the total of debits and credits for a transaction must be equal. Debits do not always equate to increases and credits do not always equate to decreases. There are two different ways to record the effects of debits and credits on accounts in the double-entry system of bookkeeping. Irrespective of the approach used, the effect on the books of accounts remains the same, with two aspects (debit and credit) in each of the transactions. Thus, all financial transactions have an opposite and equal entry in at least two different accounts.

Best Online Bookkeeping Services

The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount. Double-entry bookkeeping (which is sometimes referred to as double-entry accounting) allows a business to record all its financial transactions in a structured way. Business owners who have previously operated on a single entry accounting system will want to make the switch to a double entry accounting system as soon as possible. Implementing a double entry accounting system will allow you to put your financial statements to better use so that you can measure your financial health and spot errors quickly. Principles of double entry bookkeeping is an important concept that drives every accounting transaction in a company’s financial reporting. Business owners must understand this concept to manage their accounting process and analyse its financial results.

A second popular mnemonic is DEA-LER, where DEA represents Dividend, Expenses, Assets for Debit increases, and Liabilities, Equity, Revenue for Credit increases.