In particular, a rising net income before tax might indicate positive revenue trends, cost reductions, or successful pricing strategies. Earnings before tax (EBT) reflects how much of an operating profit has been realized before accounting for taxes, while EBIT excludes both taxes and interest payments. EBT is calculated by adding just tax expense to the company’s net income. EBIT, or operating profit, measures the profit generated by a company’s operations. By ignoring taxes and interest expenses, EBIT identifies a company’s ability to generate enough earnings to be profitable, pay down debt, and fund ongoing operations. This is especially true in retirement when most of us have a set amount of savings.

- So if you live in one of those two states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits).

- The operating costs of a company may include any expenses related to its daily activities, such as salary and wages, rent, and other overhead expenses.

- One way or the other, seeing what a person actually brings home compared to what they make can be a little more than heartbreaking.

- Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year.

These varying tax environments can significantly impact a corporation’s net income. It’s also worth noting that some countries have varying tax rates and structures which can substantially impact after-tax profits. Therefore, comparing net income before tax across companies based in different tax jurisdictions can provide a more level ground for analysis.

Bonuses may have additional tax withheld

— In recent years South Carolina has seen a reduction in personal income tax rates from 7% in 2022 to 6.5% in 2023. The federal income tax as we know it was officially enacted in 1913. Investors prefer to extract as much information about a company’s financial health as possible, prior to making an investment decision. It showcases a corporation’s raw profitability, representing the potential profit the company would have generated before the tax authorities step in. Through this, an investor can accurately assess how efficient a corporation’s operations are, and the likelihood of their investment growing within that organization. Moreover, several governments give financial incentives such as tax credits, grants, or subsidized loans to businesses that adopt sustainable practices, further enhancing their effect on net income before tax.

- FICA contributions are shared between the employee and the employer.

- If the child has both earned and unearned income, both amounts must be added together to determine if the total income triggers the mandatory filing requirement.

- While EBT normalizes for taxes, EBIT normalizes for both taxes and interest expense.

- Using an after-tax net income metric might not yield a fair comparison of corporations operating in different countries due to differing tax implications.

Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. Everything above is about your federal income taxes, which comprise the majority of your taxes. Depending on where you live, you may also have to pay state income taxes. The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine your effective tax rate, divide your total tax owed (line 16) on Form 1040 by your total taxable income (line 15). Whether or not you get a tax refund depends on the amount of taxes you paid during the year.

While it often makes sense to file jointly, filing separately may be the better choice in certain situations. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too.

Because interest and depreciation and amortization, like taxes, are expenses that don’t necessarily reflect a company’s ability to generate earnings from its operations. You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file taxes to get a refund check. If you’re looking to reduce your taxable income to the point where you’re not required to file taxes, there are a number of steps you can take.

Does the tax on your year-end bonus check seem high? Here’s why

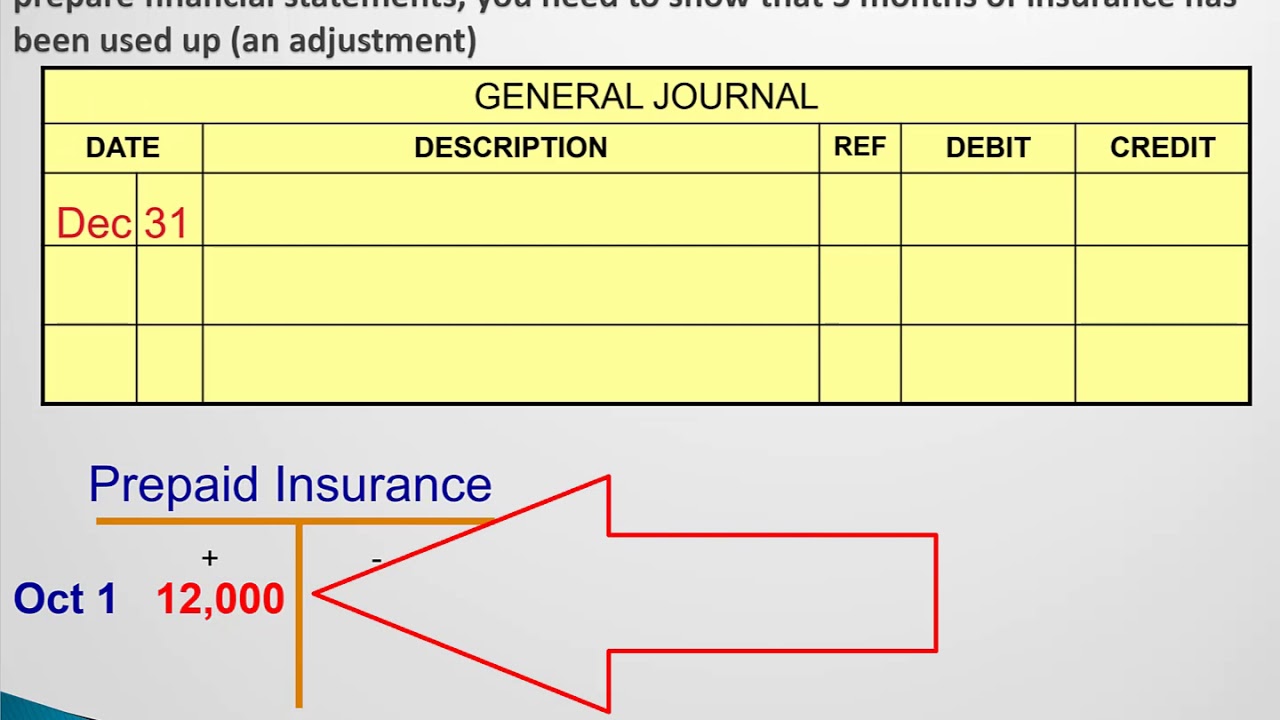

The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. One of the most important lines to understand on an income statement is income before taxes. After deducting interest payments, and depending on the business and other expenses, you’re left with the profit a company made before paying its income tax bill. If you’re not required to file taxes, you may still want to consider filing a tax return.

Each of your paychecks may be smaller, but you’re more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. Deciding how to take your deductions — that is, how much to subtract from your adjusted gross income, thus reducing your taxable income — can make a huge difference in your tax bill. Generally speaking, this means that your income is divided into portions called tax brackets, and each portion is taxed at a specific tax rate. High earners pay more in taxes, as portions of their income are subject to higher tax rates.

More Definitions of Income Before Income Taxes

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Furthermore, gross margin and operating margin are 50% and 30%, respectively. To convert the result into percentage form, the resulting amount from the formula above must be multiplied by 100.

The Utility of Income Before Taxes

If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. All corporations are required to file a tax return—even if the business doesn’t generate any income for the tax year. In 2020, 49% of individual tax returns — roughly 81 million — were in a marginal income tax bracket below 22%, according to IRS statistics. That figure includes taxpayers in the 10% and 12% tax brackets but excludes those in the 0% bracket.

Analysts often prefer to add back taxes to net income, so that they can have an apples-to-apples comparison of earning power across a broad range of companies. The marginal tax rate is the tax rate paid on your last dollar of taxable income. Broadly, this means that the government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each chunk gets taxed at the corresponding tax rate. The highest tax rate, the marginal rate, applies to only a portion of your income. To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income (AGI). Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify (either itemized or standard) to arrive at taxable income.

If interest income is derived from bond investments, it may be excluded. Many retirement plans also allow individuals aged 50 years or older to make annual catch-up contributions. You have until Tax Day to make the catch-up contribution apply to your previous year. So, when you calculate your combined income for Social Security tax purposes, your withdrawals from a Roth IRA won’t count as part of that income.

Since companies may pay different tax rates in different states, EBT allows investors to compare the profitability of similar companies in various tax jurisdictions. Further, EBT is used to calculate performance metrics, such as pretax profit margin. It reveals a company’s earnings before taxes are deducted, is calculated by subtracting all https://personal-accounting.org/understanding-income-before-tax-on-an-income/ expenses excluding taxes from revenue, and appears as a line item in the income statement. Add another $9,000 of income, and that filer would face taxes on up to 85 percent of her benefits. For joint filers, the tipping point is about $9,900 to hit the 50 percent tax threshold, and it’s a bit less than $22,000 for the 85 percent threshold.