By submitting a conditional waiver, no rights are waived until payment is made. At the same time, once payment comes, lien rights for that payment are permanently waived. construction billing A business with a quick ratio above 1 is regarded as liquid, meaning that it has enough cash resources to pay its current liabilities. Conversely, a business with a quick ratio below 1 does not have enough cash resources, so it will need to get an influx of cash through financing or by selling other long-term assets. Each section of the balance sheet — assets, liabilities, and equity — provides a different view into the company’s finances.

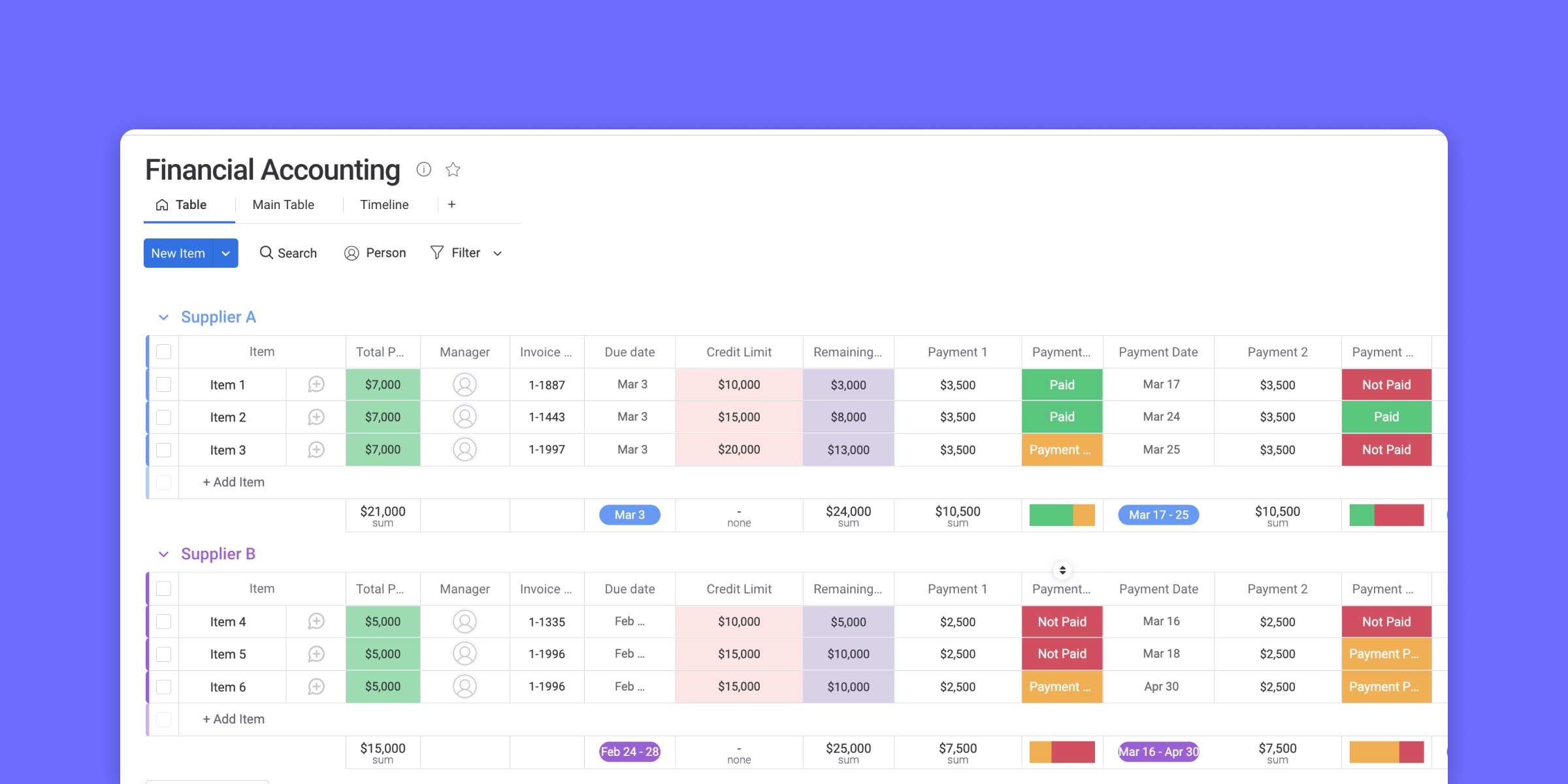

Accounting Integrations

It also ensures that financial statements accurately reflect the company’s financial position. In a way, any contract that allows retainage (and most of them do, regardless of the type of contract) is a form of arrears billing. Although the final cost is undetermined, you do need to provide a rough cost estimate by listing your hourly rate, an approximate number of hours, and a general list of materials. While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered https://www.bookstime.com/blog/oil-and-gas-accounting into…

Construction Invoicing 101: Best Practices and Billing Procedures

Obviously, that’s much quicker than the industry norm, and https://www.facebook.com/BooksTimeInc/ payment won’t come that fast for the majority of construction businesses. Still – don’t be afraid to ask for better payment terms, and don’t get pushed into accepting overly-burdensome payment terms. Building trust and a collaborative relationship with your customer will help on the path toward securing better terms. However, each contract type — in combination with the company’s chosen accounting method — will affect the business’s finances and accounting system.

- AIA billing is a standardized billing method developed by the American Institute of Architects (AIA).

- General contractors need to subtract subcontractor payments from revenues to calculate working capital turnover, as this money simply passes through the GC from the owner.

- The customer may see it as the mark of urgency, prompting them to pay sooner rather than later.

- Invoices establish a payment obligation, thereby creating an account receivable.

- Construction accounting and financial management refer to the specialized branch of accounting that addresses the unique monetary concerns and practices within the construction industry.

Main Construction Billing Methods

This accounting method is particularly useful for large construction businesses and companies with long-term contracts. Use this construction project invoice template to capture the details of project-specific construction work. To create a bill for your services, enter the client’s information, materials quantity and rate, a description of work, a labor description, hours worked, and rate, as well as miscellaneous charges. This construction invoice template can serve as an agreed-upon contract for proposed construction project work, or as a confirmed invoice. This template also allows you to upload your own logo, and it autotallies the subtotals of each section, plus tax rate, total tax, and grand total.

- To create a bill for your services, enter the client’s information, materials quantity and rate, a description of work, a labor description, hours worked, and rate, as well as miscellaneous charges.

- Project costs and WIP reports are essential components of the financial close, and delays in receiving this information from project managers can slow down the entire process.

- One way to mitigate this problem is to structure contracts with the profit evenly distributed rather than front-loaded.

- Arrears billing in construction is the process of billing at the end of a project.

- For example, a contract could establish $50 per square foot of tile installed, with the exact square footage determined at project completion.

- Please guide us what is an average timeframe from day one today to Foreclose?

- The contract includes a set price per unit, and the customer pays for the units needed.

Cost-Plus

However, fixed-price contracts can still be altered or amended by change orders. Submitting an invoice for the work or materials you provide is only one small step — it’s not a “send it and forget it” scenario. There are a number of steps construction businesses should take before, during, and after any project to ensure payment is fast and smooth.

Choose the Right Accounting Method for Your Business

This incremental approach reduces the pressure at month-end and ensures that the accounting team has a head start on the close. 1-800Accountant can support your business with real-time, accurate bookkeeping so you can gain confidence in your financial reporting. You can better understand your financial health and prepare for tax season.Schedule a free call with 1-800Accountant to learn how professional CPAs can support your construction business. Construction companies often generate additional reports due to their contracts’ long-term, complex nature.