This may be true with certain computer equipment, mobile devices, and other high-tech items, which are generally useful earlier on but become less so as newer models are brought to market. Depreciation is charged according to the above method if book value is less than the salvage value of the asset. No more depreciation is provided when book value equals salvage value. The number of years over which the basis of an item of property is recovered. Passenger automobiles; any other property used for transportation; and property of a type generally used for entertainment, recreation, or amusement. Expenses generally paid by a buyer to research the title of real property.

Declining balance method definition

Book value is the original cost of the asset minus accumulated depreciation. Both these figures are crucial in DDB calculations, as they influence the annual depreciation amount. This formula is best for small businesses seeking a simple method of depreciation.

- However, a database or similar item is not considered computer software unless it is in the public domain and is incidental to the operation of otherwise qualifying software.

- If you buy property and assume (or buy subject to) an existing mortgage or other debt on the property, your basis includes the amount you pay for the property plus the amount of the assumed debt.

- During the fourth week of each month, you delivered all business orders taken during the previous month.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- The section 179 deduction limits apply both to the partnership and to each partner.

What is the Declining Balance Method?

It allocates $40,000 of its section 179 deduction and $50,000 of its taxable income to Dean, one of its partners. Unless there is a big change in adjusted basis or useful life, this amount will stay the same throughout the time you depreciate the property. If, in the first year, you use the property for less than a full year, you must prorate your depreciation deduction for the number of months in use. It also explains how you can elect to take a section 179 deduction, instead of depreciation deductions, for certain property and the additional rules for listed property. Choosing the right method of depreciation to allocate the cost of an asset is an important decision that a company’s management has to undertake. Companies need to opt for the right depreciation method, considering the asset in question, its intended use, and the impact of technological changes on the asset and its utility.

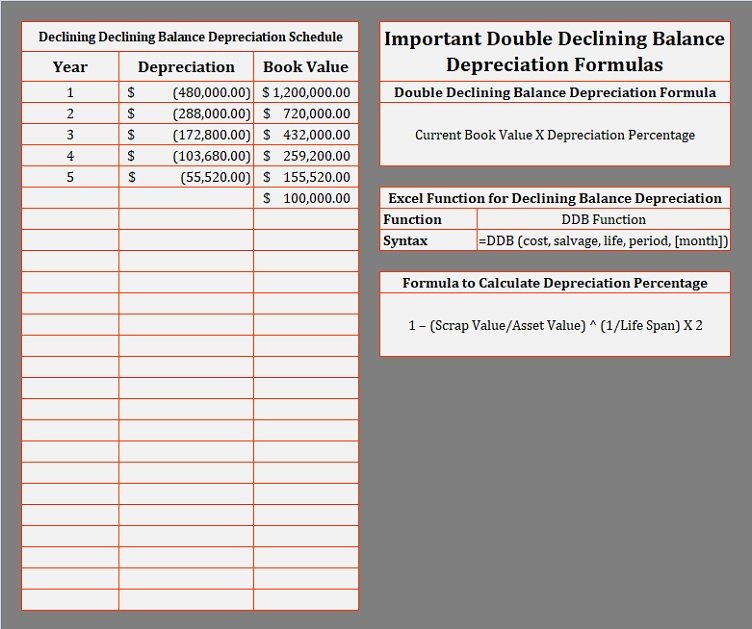

How To Calculate Double Declining Balance Depreciation

In that case, we will charge depreciation only for the time the asset was still in use (partial year). Like in the first year calculation, we will use a time factor for the number of months the asset was in use but multiply it by its carrying value at the start of the period instead of its cost. In the accounting period in which an asset is acquired, the depreciation expense calculation needs to account for the fact that the asset has been available only for a part of the period (partial year).

All of our content is based on objective analysis, and the opinions are our own. For example, if the equipment in the above case is purchased on 1 October rather than 2 January, depreciation for the period between 1 October and 31 December is ($16,000 x 3/12). These points are illustrated in the following schedule, the best small business accounting software for 2021 which shows yearly depreciation calculations for the equipment in this example. By contrast, the opposite is true when applying the straight-line method, the unit-of-production method, and the sum-of-the-years-digits method. Residual value is the estimated salvage value at the end of the useful life of the asset.

However, many firms use a rate equal to 1.5 times the straight-line rate. Under the declining balance method, yearly depreciation is calculated by applying a fixed percentage rate to an asset’s remaining book value at the beginning of each year. As an alternative to systematic allocation schemes, several declining balance methods for calculating depreciation expenses have been developed. A declining balance method accelerates depreciation so more of an asset’s value can be recorded earlier in its useful life. The flip side is that less of its value can be claimed in its later years. This method is most suitable for assets and equipment that can be expected to become useless and obsolete within a few years such as technology products.

The reason for the smaller depreciation charge is that Pensive stops any further depreciation once the remaining book value declines to the amount of the estimated salvage value. However, one can see that the amount of expense to charge is a function of the assumptions made about both the asset’s lifetime and what it might be worth at the end of that lifetime. Those assumptions affect both the net income and the book value of the asset.

The company includes the value of the personal use of the automobile in Richard’s gross income and properly withholds tax on it. The use of the automobile is pay for the performance of services by a related person, so it is not a qualified business use. On its 2025 tax return, Make & Sell recognizes $1,000 as ordinary income. This is the GAA’s unadjusted depreciable basis ($10,000) plus the expensed costs ($0), minus the amount previously recognized as ordinary income ($9,000).

However, a mere statement by the employer that the use of the property is a condition of your employment is not sufficient. Other property used for transportation does not include the following qualified nonpersonal use vehicles (defined earlier under Passenger Automobiles). Qualified nonpersonal use vehicles are vehicles that by their nature are not likely to be used more than a minimal amount for personal purposes. They include the trucks and vans listed as excepted vehicles under Other Property Used for Transportation next.