Clearly, no insurance company would sell insurance that covers an unfortunate event after the fact, so insurance expenses must be prepaid by businesses. Unexpired or prepaid expenses are the expenses for which payments have been made, but full benefits or services have yet to be received during that period. Prepaid assets are nonmonetary assets whose benefits affect more than one accounting period. They include items such as prepaid insurance and prepaid rent and essentially represent the right to receive future services. Most calculations dealing with prepaid insurance involve determining how much of that prepaid insurance expense is recognized in each accounting period. This is usually done by dividing the total premium paid by the coverage period, which may be expressed in months or years.

Benefits of Prepaid Insurance

In layman’s terms, prepaid expense is recognized on the income statement once the value of the good or service is realized, i.e, the service or good is delivered. In most cases, this is the correct entry to book, however, in certain transactions we are paying upfront for the right to use an asset or receive a service over a defined period of time. Prepaid insurance is an asset account on the balance sheet, in which its normal balance is on the debit side.

Why Is Prepaid Insurance Considered a Debit in the Asset Account?

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. HighRadius empowers accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Prepaying your insurance can seem like a tempting way to save money and simplify your finances. The company expects to use the coverage within the next year, even if the formal period extends beyond. For example, you might pay a year’s worth of car insurance upfront at the beginning of the year.

Impact of prepaid expenses on liquidity ratios

- Prepaid or unexpired expenses can be recorded under two methods – asset method and expense method.

- For example, if you have a debt obligation, such as a loan, and you owe $1,000 next month but decide to pay that amount this month, that is a prepayment.

- It provides the benefit of obtaining services at a predetermined cost, which aids in budgeting and financial stability.

- In this case, Prepaid Insurance is classified as current assets on the Balance Sheet, as shown below.

Unlike conventional expenses, businesses tend to receive something of value from the prepaid expense over the course of several accounting periods. To illustrate how prepaid insurance works, let’s assume that a company pays an insurance premium of $2,400 on November 20 for the six-month period of December 1 through May 31. The payment is entered on November 20 with a debit of $2,400 to prepaid insurance and a credit of $2,400 to cash. As of November 30, none of the $2,400 has expired and the entire $2,400 will be reported as prepaid insurance. It is included under prepaid expenses with other pre-paid items like prepaid rent, prepaid taxes, and prepaid utilities. These are the type of expenses paid in advance but that have not been incurred or used.

Do you own a business?

Among these, one particularly important type of prepaid expense is prepaid insurance. Because they represent a future benefit owed to the company, companies list prepaid expenses first on the balance sheet in the prepaid asset account. Because companies anticipate them to be consumed, employed, or spent through regular business activities within a year. The term prepaid insurance refers to payments that are made by individuals and businesses to their insurers in advance for insurance services or coverage. Premiums are normally paid a full year in advance, but in some cases, they may cover more than 12 months. When they aren’t used up or expired, these payments show up on an insurance company’s balance sheet.

Businesses can further simplify their accounting processes with AI/ML-powered Transaction Matching automating data extraction and reconciliation enabling firms to experience an auto match rate of 90%. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Based in Texas, Eric contributes significantly to Insurance Insights, leveraging his expertise to provide valuable insights into the world of insurance. His dedication to making insurance-related topics accessible sets him apart in the industry. Having spent years exclusively writing for TripAdvisor, Eric possesses a deep understanding of how to communicate complex insurance concepts to a broad audience.

The software that’s sold with this type of arrangement is often referred to as SaaS, or “Software as a Service,” because of its similarity to service contracts. Leases can be a great example of situations where a contract may require a lessee to pay a portion of their obligation prior to or at lease commencement. These types of stipulations are generally observed in real estate leases where the landlord typically requires one or two months of the monthly rent obligation upon execution of the contract or at lease commencement. Note that this situation is different from a security deposit which is generally refundable. As the policy is consumed from month to month, the policy’s value for those months will be recorded as a credit, and the entries in the two columns will eventually cancel out or total zero. The most important calculation regarding prepaid insurance reflects the unexpired portion of the policy.

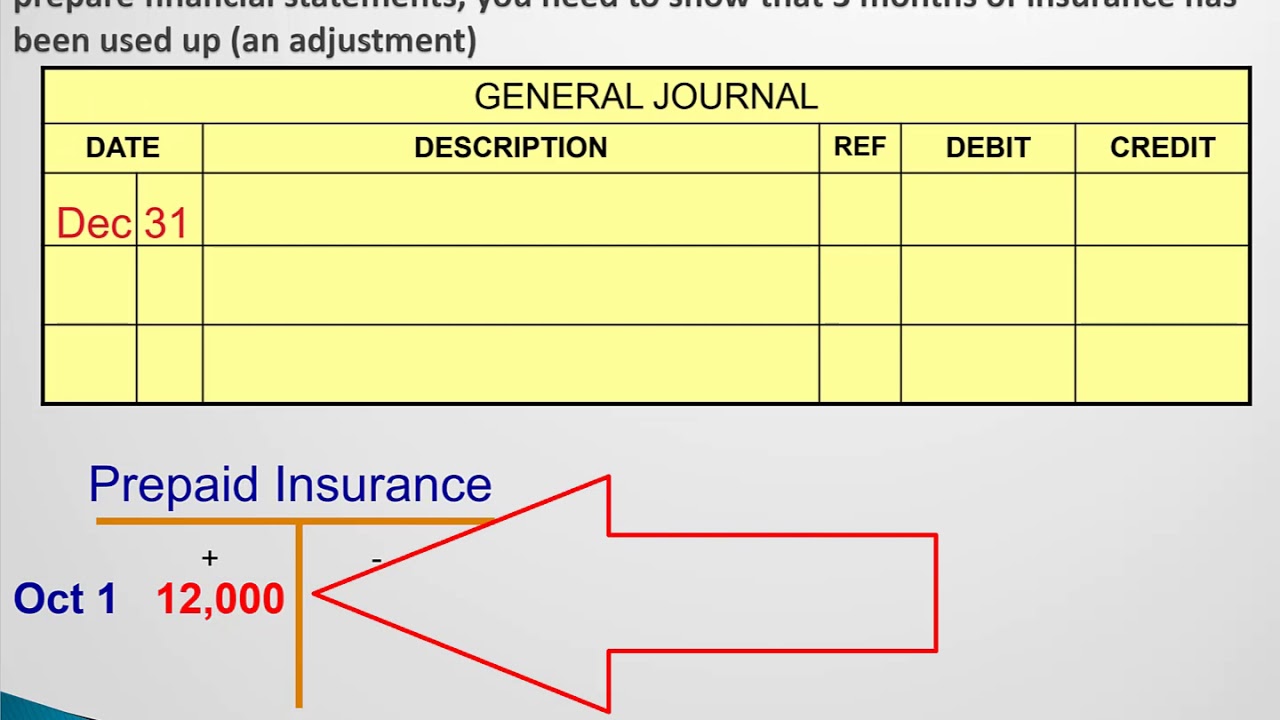

At the end of twelve months, the asset account would show a balance of zero for the insurance premium and a total of $12,000 in the insurance expense account. Prepaid insurance is recorded in the general ledger as a prepaid asset under current assets. A current asset is a financial resource that can be easily liquidated, or converted to cash, in a year or less.

In this way, the asset value of the prepaid insurance will be reduced to zero at the end of the time period which was paid for in advance. Similarly, the expense will reach the total of the prepaid amount at the end of that same period. On 1 September 2019, Mr. John bought a motor car and got it insured for one year, paying $4,800 as a premium. When he paid this premium, he debited his insurance expenses account with the full amount, i.e., $4,800. At the end of each month, an adjusting entry of $400 will be recorded to debit Insurance Expense and credit Prepaid Insurance. Notice that the amount for which adjustment is made differs under two methods, but the final amounts are the same, i.e., an insurance expense of $450 and prepaid insurance of $1,350.

Insurance providers may allow a business to pay multiple monthly premiums in advance, in the form of one lump sum. For the insurance company, it generates more working capital and greater customer retention. For example, if you have a is prepaid insurance a contra asset debt obligation, such as a loan, and you owe $1,000 next month but decide to pay that amount this month, that is a prepayment. A prepaid expense, on the other hand, is any good or service that you’ve paid for but have not used yet.

Concurrently, we are also amortizing both the long-term and short-term balances of the prepaid subscription. The business’s records would show four months of insurance policy as a current, prepaid asset. It would be entered into the general ledger as a debit of $12,000 to the asset account and a credit for the same amount to the cash account. A premium is a regular, recurring payment made to a provider for the benefit of having insurance coverage. Simply put, prepaid insurance is a payment you make for insurance coverage in advance, typically covering a period longer than one accounting period. The quick ratio, while also being a liquidity ratio, only factors in an organization’s most liquid assets such as cash and cash equivalents that can be converted the quickest, hence the same.