Investors and analysts use ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. For example, comparing the price per share to earnings per share allows investors to find the price-to-earnings (P/E) ratio, a key metric for determining the value of a company’s stock. An accounting ratio compares two line items in a company’s financial statements. These consist of its income statement, balance sheet, and cash flow statement. The ratios can be used to evaluate a company’s fundamentals and provide information about the performance of the company over the last quarter or fiscal year.

Net Profit Margin

Then, analyze how the ratio has changed over time (whether it is improving, the rate at which it is changing, and whether the company wanted the ratio to change over time). As with all accounting ratios, you can use the above calculation to compare it with a different period. Accounting ratios are used to analyse business trends and measure performance of both the business and the management. One accounting ratio viewed in isolation will not tell you a great deal about a business.

- Use the Earnings per Share Calculator above to calculate the earnings per share from your financial statements.

- The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets.

- Use the Du Pont Analysis Calculator above to calculate the Du Pont Ratios from your financial statements.

- The measure gives an idea to the leverage of the company along with the potential risks the company faces in terms of its debt-load.

Efficiency Ratios

Financial Statements are prepared by companies to demonstrate its financial activity to stakeholders. These are prepared at regular intervals, and typically contain at least a balance sheet and an income statement. The balance sheet shows the value of a company’s accounts at a given point in time. The income statement shows the financial effects of activities over a given period of time.

How Can an Investor Use Accounting Ratios?

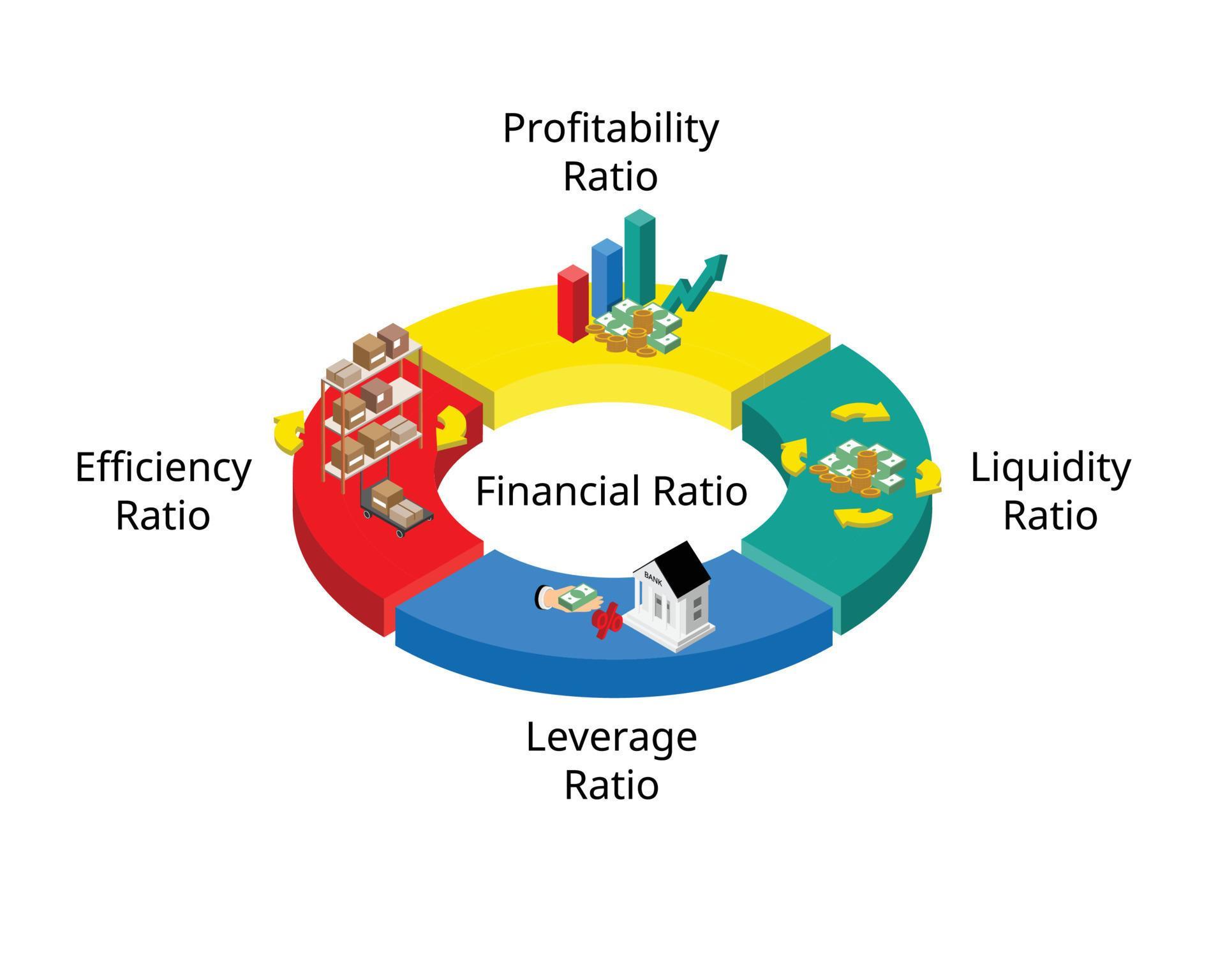

Financial ratios are mathematical comparisons of financial statement accounts or categories. There is often an overwhelming amount of data and information useful for a company to make decisions. To make better use of their information, a company may compare several numbers together. This process called ratio analysis allows a company to gain better insights to how it is performing over time, against competition, and against internal goals.

Accounting Ratios and Their Classification

Pretax Income is a made up of two sources, income from assets funded by shareholders equity, and assets funded by borrowed debt. Use the Price to Book Ratio Calculator to calculate the price to book ratio from your financial statements. Use the Dividend Payout Ratio Calculator above to calculate the dividend payout ratio from your financial statements. dividend payout ratio definition formula and calculation Use the Accounts Receivable Turnover Calculator to calculate the accounts receivable turnover from your financial statements. Use the Operating Margin Calculator to calculate the operating margin from your financial statements. Use the Return on Common Equity Calculator above to calculate the return on common equity from your financial statements.

Accounts Receivable Turnover is used to quantify a firm’s effectiveness in extending credit as well as collecting debts. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets. Operating Margin shows the profitability of the ongoing operations of the company, before financing expenses and taxes. What might be considered as an important accounting ratio in one industry may not be as important in another. Each of these ratios provides a window into a specific aspect of company operations. Accounting ratios are also used to spot and analyze companies in potential financial distress.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Use the Du Pont Analysis Calculator above to calculate the Du Pont Ratios from your financial statements. As such, it is always best to use the ratios together to analyze an outfit.

Total return on equity is the profitability, multiplied by the rate of asset turnover, multiplied by the ratio of assets to equity (leverage). By identifying each component and evaluating, strength and weakness can be evaluated, as well as insight into competitive advantage. Understanding how each element leads to return on equity will help a researcher investigate further into the operations of a company.