Content

- Beginning of Period Retained Earnings

- Best Free Accounting Software for Small Businesses

- What does the statement of retained earnings include?

- Terms Similar to the Statement of Retained Earnings

- State the Retained Earnings Balance From the Prior Year

- What is the Statement of Retained Earnings?

- Add Net Income From the Income Statement

- How to calculate the effect of a stock dividend on retained earnings

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. However, for other transactions, the impact on retained earnings is the result of an indirect relationship. That means Malia has $105,000 in retained earnings to date—money Malia can use toward opening additional locations. While the term may conjure up images of a bunch of suits gathering around a big table to talk about stock prices, it actually does apply to small business owners. In this article, you will learn about retained earnings, the retained earnings formula and calculation, how retained earnings can be used, and the limitations of retained earnings.

Although the statement of earnings is not one of the main financial statements, it is useful in tracking your business’s retained earnings and seeking outside financing. The statement of retained earnings is not one of the main financial statements like the income statement, balance sheet, and cash flow statement. And like the other financial statements, it is governed by generally accepted accounting principles. statement of retained earnings example Retained earnings are the portion of a company’s net income that management retains for internal operations instead of paying it to shareholders in the form of dividends. In short, retained earnings are the cumulative total of earnings that have yet to be paid to shareholders. These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt.

Beginning of Period Retained Earnings

The statement of retained earnings for a given accounting cycle opens with the amount of the retained earnings at the start of the reporting period. Then, the net profit for the period after the payment of dividends is added to arrive at the amount of the retained earnings at the end of the reporting period. The statement of retained earnings is either created as a separate document or appended with the income statement and balance sheet. It is prepared to benefit existing and prospective external stakeholders, such as investors and lenders.

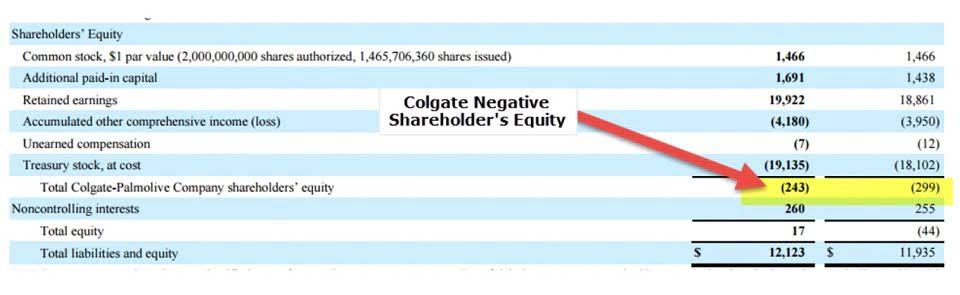

It is possible for a company not to raise enough revenues to cover its costs. In that case, the company operated at a net loss rather than a net profit for the accounting period. That loss, which is a negative profit, would translate to negative retained earnings. One piece of financial data that can be gleaned from the statement of retained earnings is the retention ratio. The retention ratio (or plowback ratio) is the proportion of earnings kept back in the business as retained earnings. The retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends.

Best Free Accounting Software for Small Businesses

Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business, to learn more about the different types of financial statements for your business. Here we’ll go over how to make sure you’re calculating retained earnings properly, and show you some examples of retained earnings in action. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. Below is the balance sheet for Bank of America Corporation (BAC) for the fiscal year ending in 2020. If you calculated along with us during the example above, you now know what your retained earnings are. Knowing financial amounts only means something when you know what they should be.

The statement of retained earnings is also called a statement of shareholders’ equity or a statement of owner’s equity. Investors pay close attention to retained earnings since the account shows how much money is available for reinvestment back in the company and how much is available to pay dividends to shareholders. Therefore, calculating retained earnings during an accounting period is simply the difference between net income and dividends.

What does the statement of retained earnings include?

Thus, retained earnings appearing on the balance sheet are the profits of the business that remain after distributing dividends since its inception. Since stock dividends are dividends given in the form of shares in place of cash, these lead to an increased number of shares outstanding for the company. That is, each shareholder now holds an additional number of shares of the company. Say, if the company had a total of 100,000 https://www.bookstime.com/ outstanding shares prior to the stock dividend, it now has 110,000 (100,000 + 0.10×100,000) outstanding shares. So, if you as an investor had a 0.2% (200/100,000) stake in the company prior to the stock dividend, you still own a 0.2% stake (220/110,000). Thus, if the company had a market value of $2 million before the stock dividend declaration, it’s market value still is $2 million after the stock dividend is declared.

- Then, the net profit for the period after the payment of dividends is added to arrive at the amount of the retained earnings at the end of the reporting period.

- Distribution of dividends to shareholders can be in the form of cash or stock.

- At the end of a given reporting period, any net income that is not paid out to shareholders is added to the business’s retained earnings.

- It is prepared to benefit existing and prospective external stakeholders, such as investors and lenders.

- Companies typically calculate the change in retained earnings over one year, but you could also calculate a statement of retained earnings for a month or a quarter if you want.

- Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend.

This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy.

As mentioned earlier, management knows that shareholders prefer receiving dividends. This is because it is confident that if such surplus income is reinvested in the business, it can create more value for the stockholders by generating higher returns. However, management on the other hand prefers to reinvest surplus earnings in the business. This is because reinvestment of surplus earnings in the profitable investment avenues means increased future earnings for the company, eventually leading to increased future dividends. These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested by them in your company.

At some point in your business accounting processes, you may need to prepare a statement of retained earnings, which helps people understand what a business has done with its profits. Most good accounting software can help you create a statement of retained earnings for your business. Movements in a company’s equity balances are shown in a company’s statement of changes in equity, which is a supplementary statement that publicly traded companies are required to show. Both the beginning and ending retained earnings would be visible on the company’s balance sheet. As such, the statement of changes in equity is an explanatory statement.